Taking Full Advantage Of Medical Care Insurance Coverage With Medicare Advantage Insurance

As the landscape of health care proceeds to advance, people looking for comprehensive coverage typically turn to Medicare Advantage insurance coverage for a much more comprehensive technique to their clinical requirements. The appeal of Medicare Benefit hinges on its possible to supply a more comprehensive variety of solutions past what standard Medicare strategies supply. By checking out the benefits of this option, understanding enrollment procedures, and revealing cost-saving strategies, individuals can open a globe of medical care opportunities that satisfy their unique needs. What precisely does making the most of medical care insurance coverage with Medicare Benefit entail? Allow's explore the complexities of this insurance coverage alternative to uncover just how it can be maximized for your health care journey.

Advantages of Medicare Benefit

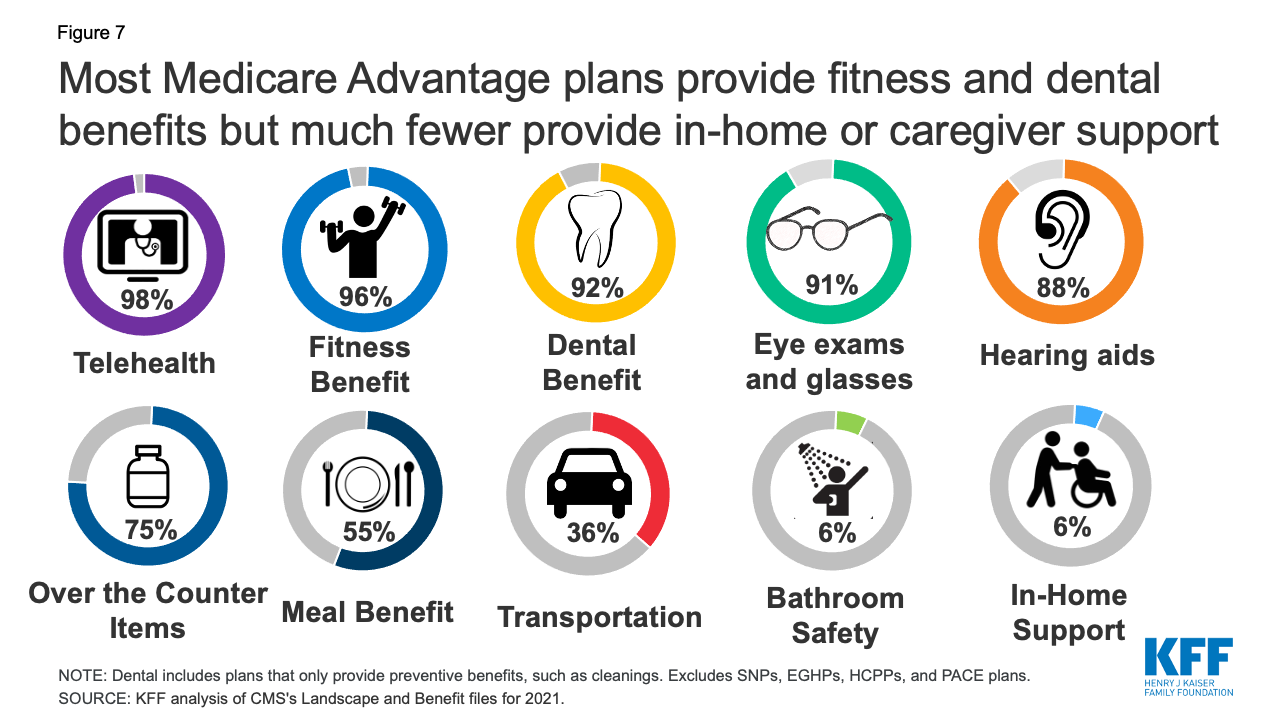

What advantages does Medicare Benefit offer over traditional Medicare strategies? Medicare Advantage intends, likewise recognized as Medicare Part C, give numerous advantages that set them besides traditional Medicare plans. One crucial benefit is that Medicare Advantage plans commonly consist of additional protection not used by initial Medicare, such as vision, oral, hearing, and prescription drug protection. This detailed coverage can help beneficiaries save cash on out-of-pocket expenditures for solutions that are not covered by traditional Medicare.

Additionally, Medicare Advantage prepares normally have out-of-pocket maximums, which limit the amount of cash a recipient needs to invest in protected solutions in a provided year. This monetary security can provide comfort and aid people allocate health care expenses better (Medicare advantage plans near me). In addition, lots of Medicare Benefit intends deal health care and various other precautionary solutions that can assist beneficiaries remain healthy and balanced and manage persistent problems

Enrollment and Qualification Requirements

Medicare Advantage strategies have certain enrollment needs and eligibility criteria that people should meet to sign up in these detailed healthcare insurance coverage choices. To be eligible for Medicare Benefit, individuals need to be registered in Medicare Component A and Part B, additionally referred to as Initial Medicare. Furthermore, most Medicare Advantage intends require candidates to live within the plan's solution location and not have end-stage renal condition (ESRD) at the time of enrollment, though there are some exemptions for individuals currently signed up in a Special Demands Strategy (SNP) tailored for ESRD patients.

Cost-saving Opportunities

After ensuring qualification and enrolling in a Medicare Benefit strategy, individuals can discover different cost-saving opportunities to optimize their medical see here care protection. One substantial method to conserve costs with Medicare Benefit is through the plan's out-of-pocket optimum limit. As soon as this limit is gotten to, the plan usually covers all added approved clinical expenditures for the remainder of the year, offering monetary relief to the beneficiary.

An additional cost-saving chance is to utilize in-network healthcare service providers. Medicare Advantage prepares often work out reduced rates with details physicians, medical facilities, and pharmacies. By staying within the strategy's network, people can gain from these reduced prices, ultimately minimizing their out-of-pocket expenditures.

Furthermore, some Medicare Advantage prepares offer fringe benefits such as vision, oral, hearing, and health care, which can help individuals save money on services that Original Medicare does not cover. Benefiting from these additional advantages can cause substantial price financial savings in time.

Additional Protection Options

Checking out supplementary health care benefits past the standard insurance coverage provided by Medicare Advantage plans can improve total wellness and health results for recipients. These extra protection choices typically include services such as dental, vision, hearing, and prescription drug coverage, which are not typically covered by Original Medicare. By availing these supplementary advantages, Medicare Benefit recipients can attend to a broader array of health care requirements, causing enhanced high quality of life and much better health management.

Oral protection under Medicare Benefit strategies can include regular exams, cleanings, and even significant dental procedures like origin canals or dentures. Vision benefits might cover eye tests, glasses, or get in touch with lenses, while hearing coverage can aid with listening device and related solutions. Prescription medication coverage, additionally called Medicare Part D, is important for managing drug costs.

In Addition, some Medicare Advantage plans deal additional advantages such as gym subscriptions, telehealth services, transport help, and non-prescription allowances. These supplemental benefits add to an extra thorough medical care technique, promoting preventative care and prompt interventions to support beneficiaries' health and wellness and health.

:max_bytes(150000):strip_icc()/Primary-Image-pitfalls-medicare-advantage-plans-e0b4733752d84973b8baad075834c35a.jpg)

Tips for Maximizing Your Plan

Exactly how can recipients make one of the most out of their Medicare Benefit strategy insurance coverage while making the most of health care benefits? Right here are some key ideas to help you maximize your plan:

Understand Your Insurance Coverage: Put in the time to examine your plan's advantages, including what is covered, any type of restrictions or constraints, and any out-of-pocket costs you might incur. Recognizing your coverage can assist you make informed medical care decisions.

Make Use Of Preventive Solutions: Numerous Medicare Benefit intends offer insurance coverage for precautionary services like testings, vaccinations, and wellness programs at no added cost - Medicare Learn More advantage plans near me. By keeping up to date on preventive treatment, you can help keep your health and wellness and possibly stop more serious wellness problems

Testimonial Your Medicines: Make certain your prescription drugs are covered by your plan and discover opportunities to save money on costs, such as mail-order drug stores or generic choices.

Final Thought

In final thought, Medicare Advantage insurance supplies many benefits, cost-saving opportunities, and additional protection choices for qualified individuals. By maximizing your strategy and taking benefit of these advantages, you can guarantee detailed medical care insurance coverage.

:max_bytes(150000):strip_icc()/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png)

:max_bytes(150000):strip_icc()/what-main-business-model-insurance-companies.asp-FINAL-092abcf238d348c4975e1021489191e6.png)